How Skippi Is Tapping India’s Appetite For ‘Chuskis’ And Confectionery With A Modern Twist

SUMMARY

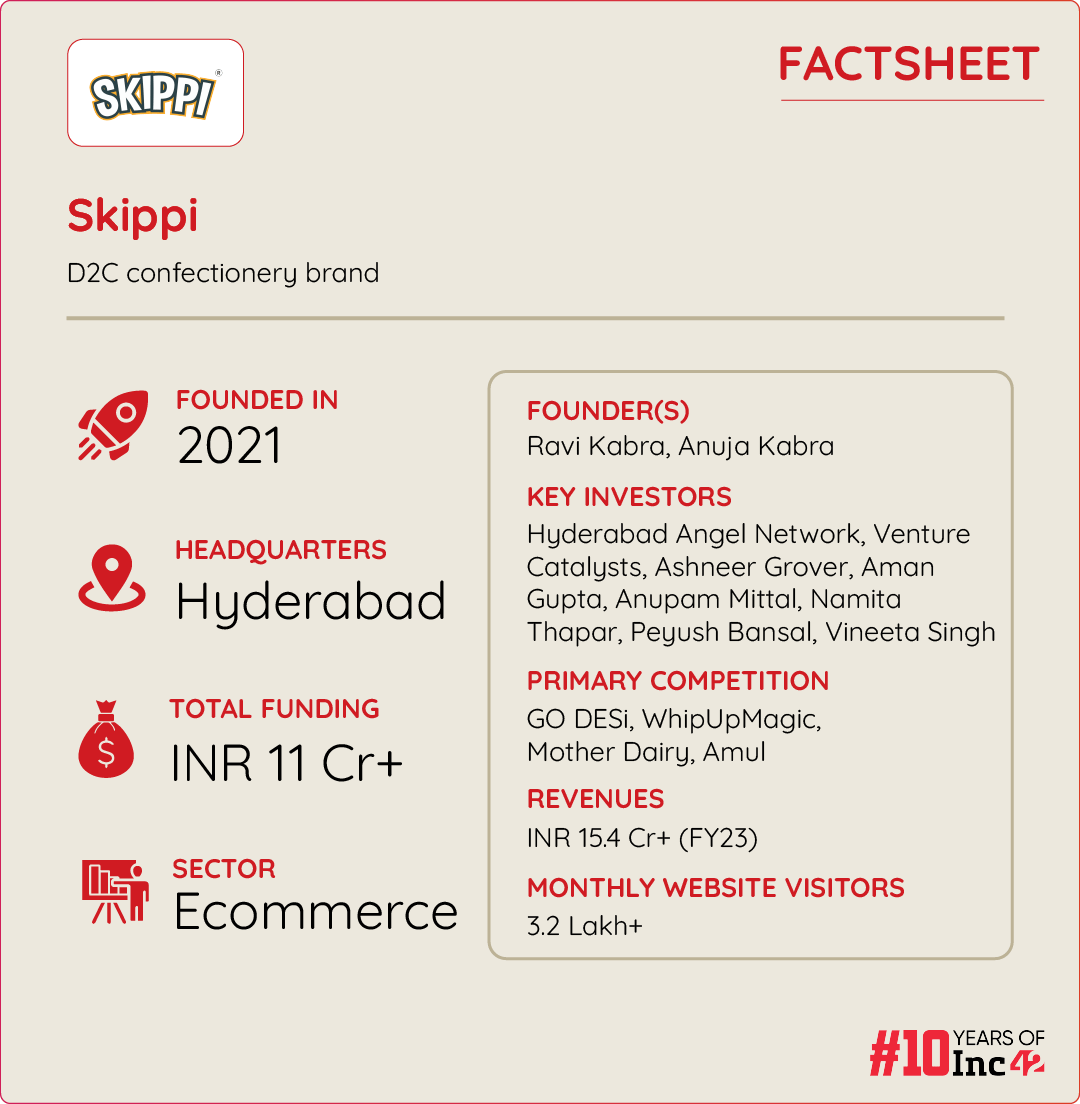

Identifying a big gap in the Indian ice popsicles market, largely dominated by a hand full of global and Indian players, Ravi and Anuja Kabra founded in Skippi in 2021

The Hyderabad-based startup, which offers ice popsicles that are 100% natural and free from artificial colours, flavours, and preservatives, is available at over 14,000 outlets nationwide

When Skippi started on Shark Tank in FY22, it was generating about 2.5 Cr. Following its appearance on the show, its revenues skyrocketed to nearly INR 15.4 Cr in FY23

In the sweltering heat of an Indian summer, nothing brings more joy than having an ice popsicle, aka ice gola or chuski. Not only do these colourful delights boast a history that spans across many cultures and regions but their global market is also set to soar to $8.9 Bn by 2032.

While giants like Unilever, Nestlé, Mengniu, and Yili dominate the ice popsicle market worldwide, Mother Dairy, Amul, and Kwality Walls are some of the prominent players in the Indian market.

However, identifying a big gap in the Indian ice popsicles market, which is largely dominated by a hand full of global and Indian players, Ravi Kabra and Anuja Kabra founded in Skippi in 2021.

The Hyderabad-based startup offers different flavour popsicles, cream rolls and corn sticks via an omnichannel retail business model. Available at over 14,000 outlets nationwide, the founders claim that they provide ice popsicles that are 100% natural and free from artificial colours, flavours, and preservatives.

The startup also sells its products on Zepto, Blinkit, Swiggy, Cred, Amazon, Flipkart, and BigBasket. Additionally, its products are available in Kuwait, Oman, Dubai, Nepal, Bhutan, Singapore, and the UAE. Today, approximately 50% of its sales come from online channels and 50% from offline channels.

Speaking with Inc42, Anuja said that while Skippi’s advantage rests in being India’s first exclusive ice popsicle brand, the claim to fame was the appearance on Shark Tank India in Season 1. Notably, Skippi was able to secure a deal from all five judges on the show for INR 1.2 Cr in exchange for 5% equity.

The startup has raised around INR 11 Cr since its inception.

As per Ravi, when Skippi started on Shark Tank in FY22, it had closed the fiscal year at around INR 2.5 Cr in revenue. Following its appearance on the show, the startup’s revenue skyrocketed to nearly INR 15.4 Cr in FY23. The founders have set their eyes on earning INR 100 Cr in ARR in FY25.

The Skippi Chronicles

After spending a decade running his family business of biscuits manufacturing, Ravi and Anuja relocated to Australia for seven years. During this time, Ravi worked with renowned international brands like Krispy Kreme, George Weston Foods, and Kuehne Nagel, gaining valuable industry experience and insights.

In 2019, the duo decided to move back to India and start something of their own, as, by now, even Anuja had gained over 14 years of experience in the food industry.

However, as they were looking for ideas to pursue in the F&B sector, many of their propositions either hit cul-de-sacs or failed to hold their interest tightly.

While looking for ideas to start up, Ravi remembered that during his time in Australia, his sister would come to stay with them for summer holidays, and on her way back to India, she would pack ice popsicles from local brands.

“When I asked her why she would do that, she said there wasn’t a single ice popsicle brand in India she could trust due to added preservatives and flavours. This made me dive deeper into the matter,” Ravi said.

To understand the ice popsicle market in India, Ravi conducted surveys in supermarkets and at places that had heavy footfall. As luck would have it, Ravi’s sister’s thesis proved to be correct, and almost everyone had negative feedback about the products available at that time. It was at this hint of an opportunity that convinced Ravi to launch Skippi.

It was also during the six months of extensive research that the cofounders realised that an increasing number of Indians were shifting towards organic, natural, and healthy products. In line with the trend, the duo decided to develop so-called guilt free ice popsicles. For market validation, the cofounders would distribute free samples outside a movie theatre in Hyderabad.

“At the time, we did not have an FSSAI number, a barcode, or even a brand name. Still, people were happy with the product. From distributing free samples, we tried to sell our ice pops for INR 20 a piece. What infused confidence in us was the people’s willingness to buy our product,” Ravi said.

Creating Products For All

After extensive research and customer validation, the Skippi founders launched their first SKU — The Ice Popsicle Box — in April 2021. Under this package, the founders offered a box of 12 popsicles and a saver pack option with 36 popsicles. The products garnered exceptional market response. Their next move was to take the Indian Tier 2 and 3 cities by storm. For this, the duo started selling ice pops for INR 10 a piece.

After a year of experimentation, they expanded their product line with Indianised flavours. Since then, the brand has been launching a new product every six months and currently has a total of 15 SKUs.

Currently, some of its best-selling products such as the All Flavor Box, Desi Box, Yellow Tropical Box, Green Tropical Box, and Single-Flavor Boxes see in the price range of INR 120 to INR 240.

Recently, it launched two new product categories including corn sticks (four flavours) and cream rolls (three flavours). “Currently, each ice popsicle sells at INR 20 at the unit level. That’s a very sweet spot for us. Our customers are happy with our price point,” Ravi said.

Interestingly, when the cofounder launched the startup, their target user base was kids. However, soon the duo realised that adults aged 30 and above, too, formed a significant part of their market, primarily due to the childhood nostalgia.

It is on the back of this market discovery that the startup was able to sell close to 2 Cr popsicles last year, the cofounders said. They aim to surpass the 40 Cr mark this year.

The company claims to have experienced year-on-year growth of 60-70%, with a 38% repeat customer rate. In addition, the startup’s average order value (AOV) has increased from INR 180 initially to almost INR 310 this year.

Skippi’s Future Roadmap

As per the admission by the founders, Skippi experienced a transformative boost after appearing on Shark Tank. It became a household name and achieved significant brand recall, so much so that many people recognise it as a Shark Tank brand, the cofounders claimed.

“The exposure resulted in a surge of website traffic and thousands of orders, with the website receiving lakhs of hits the next day. While the initial spike lasted about a week, Skippi continues to enjoy a significant footfall to date,” Ravi said.

Before the show, Skippi averaged 80,000 to 90,000 visitors monthly, a number that increased to 3.2 Lakh monthly visitors post their Shark Tank appearance. Its offline coverage, too, has expanded from 1,200 outlets to 14,000 outlets.

Next, the cofounders plan to expand Skippi to 1 Lakh outlets across India by FY25, with initial focus on A and A+ category outlets in top Indian cities. They aim to enhance their online presence and have started establishing partnerships in international markets like Saudi Arabia and Dubai. Additionally, the brand is preparing to launch on Amazon US to target the US and UK markets in the coming month.

While Skippi aims to capture the Indian market by rapidly scaling up using both online and offline channels, it has several challenges ahead of it with the prominent being keeping the resembling counterfeit products at bay.

“We are concerned about local brands that are either imitating our branding or claiming to be affiliated with Skippi, potentially confusing consumers. To address this, we are focussing on raising awareness among consumers,” the cofounders said.

In a market full of brands offering ice popsicles, it would be important for Skippi to maintain its brand uniqueness going ahead. If the brand is able to stay ahead of the product differentiation curve in the market otherwise dominated by deep-pocketed ice-cream players, it will have much to relish in the sector that is projected to offer an INR 95,600 Cr opportunity by 2032.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed, but trackbacks and pingbacks are open.