Everything You Need To Know About Custom Duty Changes Of Budget 2024

Budget 2024 stirred a mixed bag of emotions among its audience. While some were pleased, others were disgruntled, but few felt truly satisfied. The first budget of a government’s new term is always challenging. They must fulfill election promises, keep their vote bank and coalition members content, and take a firm stand on their policies.

This budget had a lot to offer, but let’s focus on a crucial aspect that impacts both investors and consumers: Custom Duty.

What is Custom Duty?

Custom Duty is a tax imposed on imported goods. Adjusting this tax can significantly affect consumer prices, local industries, international trade relations, and government revenue.

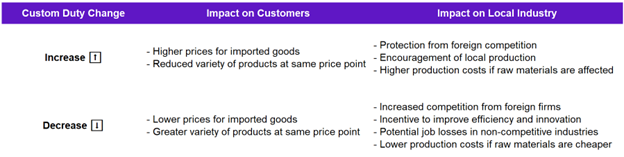

Here’s a quick look at how Custom Duty impacts customers and industries:

It’s clear that labeling any change in Custom Duty as purely good or bad is overly simplistic. The decision must consider the state of the affected industries and the government’s objectives.

Custom Duty Trends Over the Years

Before diving into the recent budget changes, let’s examine how Custom Duty rates have evolved in India compared to imports.

Customs duties saw a sharp decline in 2017-18 and then stabilized. In an ideal capitalist economy, such duties might be zero, eliminating economic inefficiencies and fostering competition. However, economics and politics are complex. Zero Custom Duty could harm local MSMEs, unable to compete with global giants.

2024 Union Budget: Custom Duty Changes

Now, let’s explore the specific changes in Customs Duty announced in the 2024 Union Budget.

Increased Custom Duty (making imports more expensive):

- Ammonium nitrate (used in agri-chemicals)

- PVC flex banners

- Telecom Equipment

Decreased Custom Duty (making imports cheaper):

- Precious metals (gold, silver, and platinum)

- Cancer medicine and X-ray machines

- Mobile phones, circuit boards, and chargers

- Critical minerals

- Raw materials for solar cells and panels

- Shrimp and fish feed

- Raw materials for leather, textile garments, and footwear

- Steel and copper inputs

- Inputs for electronic items (resistors and connectors)

This is a sign that the government is reducing the customs duty on products that have attained maturity in domestic manufacturing, which is a smart use of custom duty. However, the most important step is the commitment to tackle the inverted duty structure through a six-monthly drive.

What is Duty Inversion, you ask?

Duty inversion happens when finished products are subject to lower import duty than the inputs needed to make them.

Imagine an electronics industry where the import duty on finished smartphones is 10%, but the duty on imported electronic components is 20%. Local manufacturers assembling smartphones in India would face higher costs for importing components compared to the finished smartphones imported directly. This creates a disadvantage for local manufacturers, as consumers might prefer the cheaper imported smartphones, undermining the growth of domestic smartphone manufacturing.

Such structures exist in pockets of textiles, apparels, and engineering goods. Addressing these will be beneficial for local manufacturers, promoting fair competition and supporting the growth of domestic industries.

How Should Investors Interpret These Changes?

As investors, it’s crucial to delve deeper into the implications of these changes. Here are a few key areas to consider:

Mobile Manufacturing

Mobile manufacturing in India was at a nascent stage early on. To boost this sector, the Production Linked Incentive (PLI) scheme allocated ₹40,000 crores towards mobile manufacturing, attracting companies like Foxconn, Apple, and Samsung to set up operations in India.

Now that the industry is more established, the government is reducing custom duty to foster competition. While this might seem like a drawback for investors, as government support appears to be tapering off, it also signals that the industry is maturing. This maturity implies that the sector is progressing towards profitability without needing extensive government backing.

Critical Minerals

Critical minerals are essential for economic development and national security. The concentration of extraction or processing in limited geographical locations can lead to supply chain vulnerabilities and disruptions.

Currently, India relies heavily on imports to meet the demand for these minerals. Industries such as high-tech electronics, telecommunications, transport, defense, and green technologies (solar panels, wind turbines, batteries, and electric vehicles) depend on these minerals.

Given India’s significant domestic demand and potential in these sectors, reducing import duties on critical minerals can stimulate growth, job creation, income generation, and innovation. Additionally, cheaper procurement of these minerals will benefit industries requiring high-quality, reliable materials for extreme conditions and complex functions.

Marine Products, Leather and Textile, Steel, and Copper

Investors in these industries should also be optimistic. Key raw materials used in manufacturing are seeing a reduction in custom duty, which can be beneficial in two ways:

- Increased Margins: Reduced raw material costs can lead to higher profit margins if companies choose not to pass the savings to consumers.

- Increased Consumption: If companies pass the cost savings to consumers, cheaper goods might lead to higher consumption, particularly in price-sensitive markets.

Overall, these changes can enhance profitability and stimulate demand in these sectors, making them attractive investment opportunities.

Conclusion

The 2024 Union Budget brings notable changes in Custom Duties that reflect a move towards a more self-sufficient and competitive economy. Reductions in duties for established industries and critical imports are a sign of maturity and a boost for growth.

For investors, these shifts present new opportunities to watch and act upon. By staying informed about these changes, you can better navigate the evolving market and make strategic decisions that capitalize on emerging trends.

Disclaimer

Investments in securities are subject to market risks. Read all the related documents carefully before investing.

All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Past performance does not guarantee future returns.

PhonePeWealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Registered Office Address: Office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Bellandur Village, Varthur Hobli, Outer Ring Road, Bangalore South, Bangalore, Karnataka – 560103, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst– INH000013387 and ARN- 187821. Member id: BSE – 6756 NSE 90226. CIN U65990KA2021PTC146954.

Registration granted by SEBI, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

This article is for educational purposes and should not be considered as a recommendation.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed, but trackbacks and pingbacks are open.